The Heir’s Dilemma: Cash Out Now or Renovate for More?

Losing a loved one is one of the hardest things we go through, and suddenly finding yourself responsible for their property can feel like a second job you didn’t apply for. I talk to so many executors and heirs here in Port St. Lucie who are trying to balance their grief with the business side of settling an estate. You are often caught in a tug-of-war between wanting to honor your parents’ legacy by getting the absolute highest price for their home and just wanting the emotional weight of the situation to be over.

When you boil it down, you generally have two main paths for selling an inherited property. You can go the “As-Is” route, which prioritizes speed and convenience, usually involving a sale to an investor or a cash buyer. Or, you can choose the “Fix-and-List” strategy, where you prepare the home for the open market to attract traditional buyers. It really comes down to a trade-off: are you looking for the simplest, fastest exit, or are you willing to invest time and money to potentially maximize your profit?

Option 1: The ‘As-Is’ Sale Explained

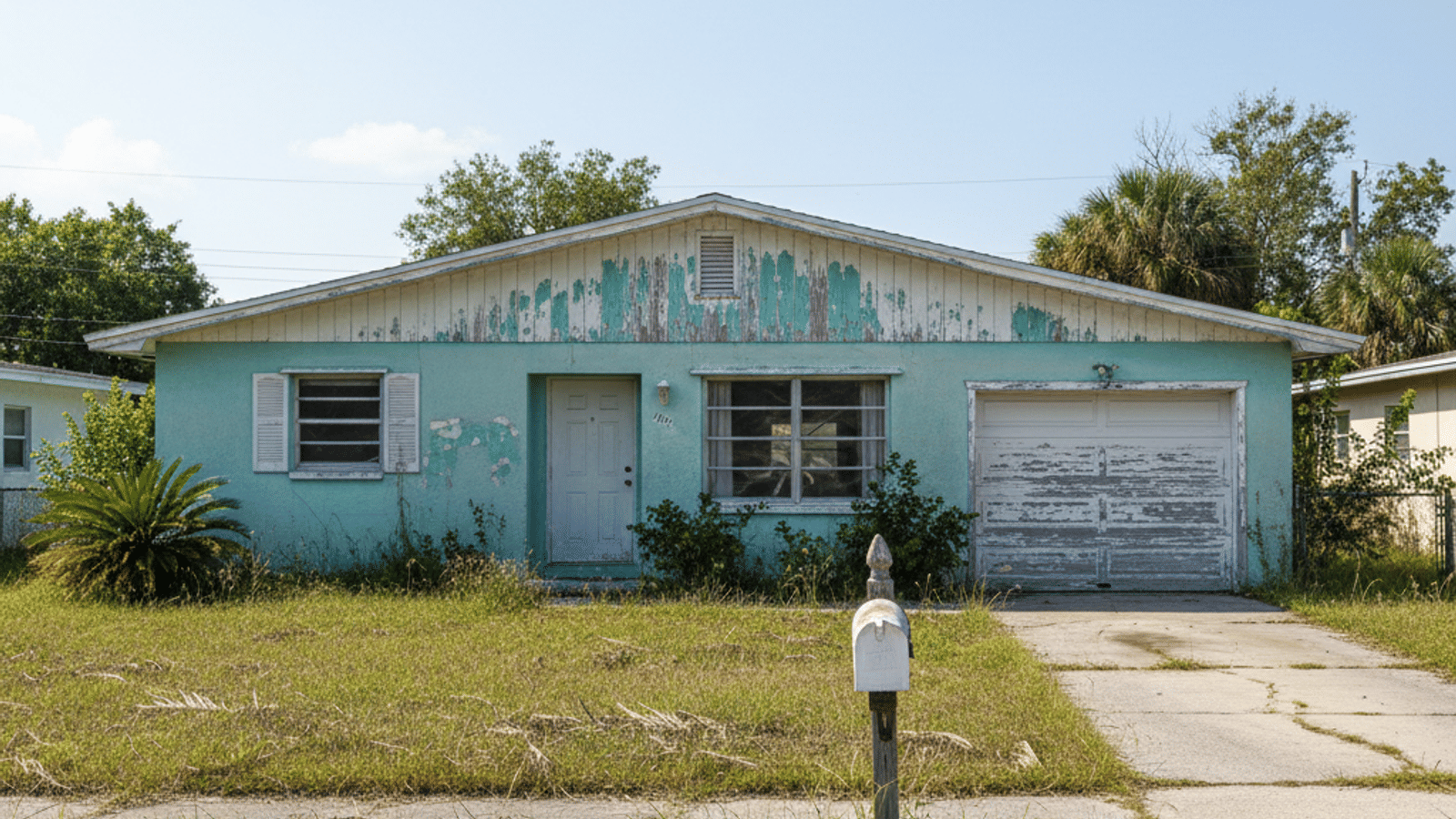

Selling a home “As-Is” is exactly what it sounds like. You are telling the buyer, “What you see is what you get.” You make no warranties about the condition of the roof or the AC, and the buyer accepts all faults, visible and hidden. This route is typically most attractive to real estate investors, professional flippers, or sometimes bargain-hunting DIYers who aren’t afraid of a project.

The biggest advantage here is speed. Because these buyers are often paying cash, we can sometimes close in as little as two to four weeks. You don’t have to spend a dime on repairs, you don’t have to manage contractors, and perhaps most importantly, you don’t have to keep revisiting the house and reliving memories. It offers almost immediate emotional closure.

The downside, naturally, is the price. Investors are running a business. To make their numbers work, they typically deduct the cost of necessary repairs plus their required profit margin from the home’s potential value. In the industry, we often see offers coming in around 70% of the After Repair Value (ARV) minus the repair costs. It’s a significant discount, but for many families, the convenience is worth the cost.

Option 2: The Fix-and-List Strategy

On the other hand, the Fix-and-List strategy is about bringing the home up to current market standards to list it with a local agent. This means handling everything from cleaning out forty years of belongings to updating cosmetics or even addressing structural issues. The goal is to make the home move-in ready for retail buyers—people who want to live there, not invest in it.

This path almost always yields the highest final sale price. By appealing to the largest pool of buyers—those looking for homes in places like PGA Village or traditional Port St. Lucie neighborhoods—you create competition that drives up value. For some heirs, there is also a sense of pride in restoring the family home to its former glory before passing it on to a new family.

However, this route requires liquid cash. You need money upfront for materials and labor, and you need the patience to wait three to six months for renovations and the closing process. It can be high stress, and there is always a risk of “over-improving” the property—spending more on upgrades than you can actually recoup in the final sale.

The ‘Hidden’ Math: Calculating True Net Proceeds

When my clients ask me which option makes more money, I always tell them to look at the “Net Sheet,” not just the top-line sale price. The sale price is a vanity metric; the net proceeds are what you actually walk away with. If you sell for $400,000 but spend $50,000 getting there, you haven’t necessarily won.

In a Fix-and-List scenario, you have to account for costs that are easy to forget. The biggest one is usually holding costs. While you are renovating, the estate is still bleeding money every month. You have to pay property taxes, utilities, and homeowners insurance—which, as we know, isn’t cheap in Florida right now. If a renovation drags on for five months, those monthly bills eat directly into your profit.

You also need to factor in agent commissions, typically around 5-6%, and closing costs. And then there is the “100% Rule” warning I give everyone: rarely does $1 spent on repairs equal $1 in added value. A brand new HVAC system might be necessary to sell the house, but it rarely adds a “wow” factor that increases the offer price dollar-for-dollar.

To give you a rough idea of what this looks like financially:

- Holding Costs: Expect to pay roughly $1,500 – $3,000 per month for taxes, insurance, HOA fees, and utilities while the house sits empty.

- Renovation Buffer: If a contractor quotes you $20,000, I always recommend adding a 20% buffer for the surprises we inevitably find behind the walls.

What to Fix? Assessing Necessary Repairs vs. Upgrades

If you decide to renovate, the trick is knowing where to stop. You want to focus on high-ROI updates, not personal passion projects. We need to distinguish between deal-breakers for buyers and “nice-to-haves.”

Critical Repairs (Must-Dos) These are the things that will stop a retail buyer from getting a mortgage or insurance. In our area, this includes leaking roofs, active mold, electrical panels that are outdated or recalled, and active pest issues. If you don’t fix these, you are likely stuck selling to cash investors anyway.

High-ROI Cosmetic Updates These are the best bang for your buck. A fresh coat of neutral paint can transform a dark, dated house into something bright and inviting. Deep cleaning, decluttering, and removing heavy drapes let the light in. Simple landscaping—fresh mulch and trimmed hedges—and replacing old carpet with modern flooring are also smart moves.

Money Pits to Avoid Stay away from massive overhauls. Full kitchen remodels are risky because tastes vary wildly; you might spend $40,000 on a farmhouse kitchen only to find the buyer wanted modern sleek. Avoid adding room additions or installing high-end luxury finishes in a mid-range neighborhood. You never want to own the most expensive house on the block.

The Non-Financial Costs: Stress, Family, and Probate

Money aside, we have to talk about the human element. Managing a renovation is stressful under the best circumstances. Doing it while grieving, or while trying to manage selling a house during probate, adds a whole new layer of difficulty.

- Decision Fatigue Clearing out a parent’s home is physically and emotionally exhausting. Every object has a memory attached to it. Adding the pressure of choosing paint colors or managing contractors on top of that can lead to serious burnout.

- Distance and Logistics If you live out of state—say, up North—and the house is here in Port St. Lucie, managing a renovation is a logistical nightmare. You aren’t here to check if the workers showed up or if the tile was laid correctly.

- Sibling Dynamics This is often the toughest part. If one sibling wants to sell fast for cash and another wants to renovate for top dollar, conflict is almost guaranteed. We sometimes see “buyouts,” where one sibling buys the other’s share to pursue the renovation, but that requires cash and legal structuring.

- Probate Timeline Renovations take time. If the sale of the property is required to close the estate, a delayed construction project keeps the probate process open longer. That means legal fees might continue to accrue and the emotional closure of “finishing” the estate administration is pushed further out.

Decision Checklist: Which Path is Right for You?

So, how do you make the final call? I try to help clients break it down into a simple framework.

You should probably choose the As-Is route if:

- You live out of state and cannot travel back and forth.

- The estate has no liquid cash to pay for repairs or holding costs.

- The heirs are in conflict and just need a clean break.

- The house needs major structural work that is too daunting to manage.

You should probably choose the Fix-and-List route if:

- The home is in a high-demand area where inventory is low.

- The house has “good bones” and mostly needs cosmetic updates like paint and flooring.

- The estate has the cash reserves to fund the work and keep the lights on for a few months.

- You have a trusted local partner or agent to keep an eye on the project.

The Middle Ground There is also a third option: the “Trash-out and Clean.” You don’t renovate, but you do empty the house, remove all the old furniture and debris, and give it a deep professional clean. This is often enough to attract some retail buyers who aren’t scared of a little wallpaper but can’t look past a house full of clutter.

A Note on Taxes: Stepped-Up Basis

One financial bright spot in this process is how capital gains taxes usually work for inherited property. When you inherit a home, the value of the property is typically “stepped up” to its fair market value on the date of the previous owner’s death.

This means if your parents bought the house thirty years ago for $100,000 and it was worth $400,000 when they passed, your cost basis is reset to $400,000. If you sell it shortly after for $400,000, you generally owe little to no capital gains tax. If you renovate and sell for $450,000, you can typically add the cost of those renovations to your basis, further reducing any taxable gain. Of course, always consult a tax professional for your specific situation, but know that the tax hit is rarely as bad as heirs fear.